It's done. It has been procrastinated since the last week in December, but it is done. I pay my business taxes on a quarterly basis, but some pay annually or biannually and it depends upon how your business is setup.

It's done. It has been procrastinated since the last week in December, but it is done. I pay my business taxes on a quarterly basis, but some pay annually or biannually and it depends upon how your business is setup.I have a simple tax certificate that allows me to purchase raw materials without paying taxes on them at that time. This is because I will be collecting taxes from the customer on those raw materials once they are used in finished products and sold to a customer. More about that around April 15.

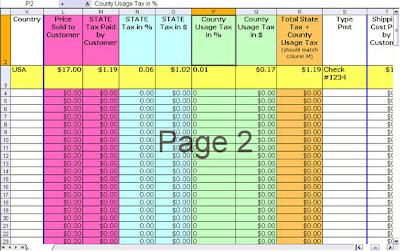

Today, I finished my quarterly sales taxes on orders I received and sent out in Q4 of 2008. My state has a state tax plus a county usage tax and each county can be a different percent, therefore, I had to do a bit of sorting, calculating, and merging to fill out the form.

I wanted to share with you GalleriaLinda's Sales, Orders, and Tax spreadsheet that I set up. It may help you and it may not. I have found that looking at and trying out a few of these kind of things can help you to identify what your custom needs are regarding your sales information. A call to your local tax office or accountant (even if it is hubby in the next room) will help you to understand what you will need to document.

Now is the time to get your documentation procedures in place so you are not left in a mess at the end of the year!

Disclaimer about the spreadsheet: I am not an expert at Excel. I do not know your state's tax requirements. I am not an accountant. I can barely add 2+2. SO, this is shared as a resource in concept for you to take and make your own.

I have formulated the calculating cells for what I have in this spreadsheet. If you change or tweak this sheet, they may not work for you. I suggest you find a person proficient in Excel to be sure your calculations work well when you finish making it your own.

No comments:

Post a Comment